If you were able to get a loan under the Payroll Protection Program (PPP) recently, you should be aware of some important follow-up guidance recently released by the IRS which may impact your taxes.

PPP loan forgiveness, self-employment income and your taxes

Based on the new PPP guidance available to date (which is fluid and subject to change) any expenses eligible to be forgiven from your loan amount cannot also be deducted on your taxes. This means that normally tax-deductible expenses such payroll expenses, mortgage interest, rent and utilities are not deductible on your 2020 taxes in the amount that you receive PPP loan forgiveness on them.

In addition, you cannot apply for PPP loan forgiveness on home office deductions, self-employed health insurance or retirement contributions for a business owner. However,

if you have a free-standing office that you pay rent on or you pay health insurance or retirement contributions for employees these can be counted as part of your PPP loan forgiveness amount.

Another important exception to this inability to deduct expenses that are covered under your PPP loan is self-employment income. If you received a PPP loan and used Line 31 on Schedule C of your 2019 tax return to support your loan application, this is the amount of self-employment income this amount can be factored into your calculation of how much of your PPP loan can be forgiven.

How to calculate your self-employment PPP loan forgiveness amount

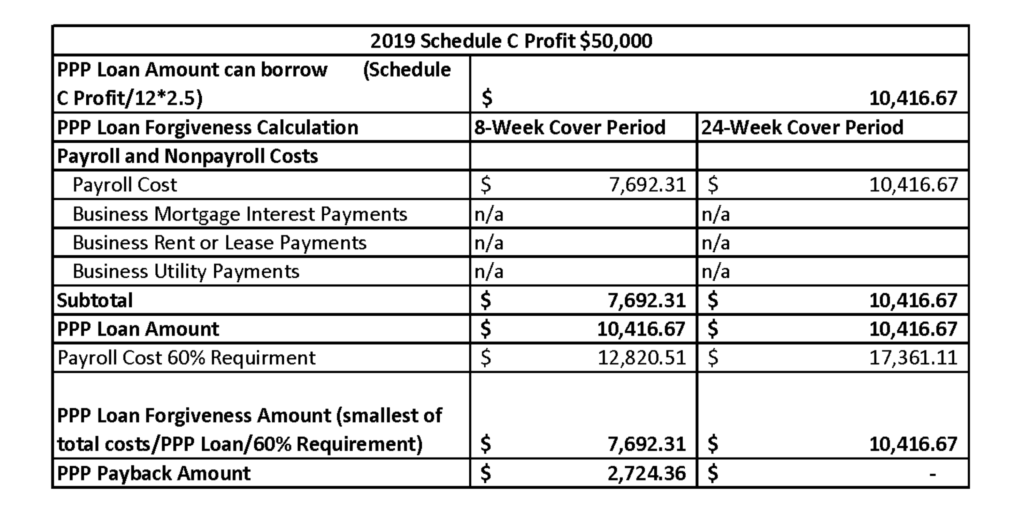

Here’s an example of the calculation. If you are a freelancer who had $50,000 of net income on Schedule C of your 2019 tax return, when you apply for PPP loan forgiveness (see details on this below) you can calculate the amount that you can seek loan forgiveness for as follows:

Your self-employment income allowed for PPP loan forgiveness, based on your 2019 Schedule C will be capped at $7,692.31 ($50,000 divided by 52 and then multiplied by 8). This is the amount you would submit to your lender along with any other eligible expenses that you used the PPP loan money for.

PPP loan forgiveness is not automatic—be sure you apply for it

Another important caveat in the PPP loan forgiveness equation that you should be aware of is that currently, it appears that you have to specifically request loan forgiveness by submitting a request to the lender that is servicing the loan. You will need to provide documents that verify you used PPP funds to make payments on eligible mortgage, lease, and utility obligations. As stated above, you can use your 2019 Schedule C from your tax return to satisfy the self-employment income verification.

Be sure to watch for more details on how applying for PPP loan forgiveness will work in the news media, from your lender and from the IRS and/or SBA. The mechanics of this part of the PPP program have yet to be formally detailed.

Your lender is required to make a decision on the forgiveness of your loan within 60 days. Keep in mind, any PPP amount not forgiven is loaned at 1% interest rate, with a two-year maturity period and the first payment is due in six months.

On June 7, The Payroll Protection Program Flexibility Act was passed into law, extending the covered period in which borrowers can use Payroll Protection Program (PPP) loan proceeds from eight weeks to 24 weeks. This extension applies to freelancers who received their disbursement prior to the enactment of the PPP Flexibility Act and may be especially helpful to those without business overhead.

Keep in mind that if you elect to use the 24-week covered period, the amount that can be forgiven cannot exceed 2.5 months’ worth of 2019 compensation for any self-employed individual and the amount that can be forgiven is capped at $20,833 per individual.

Another very important note in regard to PPP loan forgiveness is that it is not automatic. Forgiveness must be granted from the company servicing your SBA loan. The lender you used to get your loan should eventually ask you to submit documentation for this purpose. However, you should also be aware that it is your responsibility to make sure your loan forgiveness request is made.

If you did receive a PPP loan, then you are (hopefully) aware that originally, the Small Business Administration had permitted borrowers to use eight weeks as the covered period. The PPP Loan Extends the “covered period” for PPP loan forgiveness from eight weeks after loan origination to the earlier of 24 weeks after loan origination or December 31, 2020.

Now that the covered period for PPP has been extended, it is important to understand how this may impact you as a freelancer. Here is an example of the potential difference in the PPP loan forgiveness, using the eight-week window vs. the 24-week window), based on an individual reporting $50,000 of self-employment income on their 2019 tax return, with no overhead expenses:

As you can see, using the 24-week covered period allows you to maximize the amount of PPP loan forgiveness available to you, which is an underlying intention of The Payroll Protection Program Flexibility Act. This is an important cost-saving to take advantage of if you are eligible to do so.

As a reminder for freelancers, the eligible expenses that can be included in the payroll calculation include any compensation or income that is a wage, commission, income, net earnings from self-employment (There is an annual income cap of $100,000, which is pro-rated for the loan forgiveness period), or similar compensation. Expenses for a free-standing, separate office or payroll cost for staff are also included.

Per the Federal Register in April 2020 there are also some important exclusions to the allowable PPP loan expenses, including home office deductions, your own health insurance costs and retirement contributions.

Given the fluid nature of the PPP program and the ambiguity that still exists around the process for applying for PPP loan forgiveness, it is essential that freelancers who have participated in the program continue to monitor additional changes and keep track of PPP-related expenses in order to maximize loan forgiveness and avoid unwelcome and unexpected repayment obligations next tax season.

What is an Economic Injury Disaster Loan (EIDL)?

If you are self-employed and do not have employees, this may be a good option for you. The federal Small Business Administration (SBA) runs the Economic Injury Disaster Loan (EIDL) program directly. A part of the loan may be forgiven (up to $10k).

What can EIDL be used for?

Payroll, fixed debts, accounts payable, other expenses that you are unable to pay directly due to the Covid-19 impact.

How much can I qualify for with EIDL?

Up to $2 million.

What are the terms for EIDL?

3.75% APR for up to a 30-year term.

How do I Apply for EIDL?

An additional $60 billion to fund Economic Injury Disaster Loans (EIDL) was part of the $484 billion additional relief package approved in late April. Apply online at covid19relief.sba.gov. It doesn’t cost anything to apply. On the application, you can check the box to be considered for an advance before your loan is finalized. You will need to provide a bank routing number and account number for them to deposit the loan advance.

How much of EIDL is forgivable?

Up to $10k available as an emergency grant, upon approval.

The SBA will determine how much loan advance they will give you, and when they will send the loan advance. If you receive a loan advance, the advance won’t have to be repaid. The loan advance may be $10,000, but it may be less.

Can I apply to Both PPP and EIDL?

Yes, you can apply for both. But you can’t use the funds from both loan programs for the same purpose. For the most updated and complete information, read the FAQs on the EIDL and FAQs on the PPP.

As of June 30, the deadline the US Treasury set the deadline for applying for PPP loans to August 8 or when the funding for the program runs out. Individual banks may terminate lending earlier. If your bank has terminated their lending, consider FinTech companies such as Blue Vine online which may accept applications closer to or even beyond the deadline.

For more information, visit The SBA has a hotline to help answer questions 1-800-659-2955, 7 days a week from 7:00a.m. to 9:00p.m.